Household Contents Cover and Building Insurance will indemnify you – What happens if your items are Underinsured?

Coffee with Quattro: FOMO is the most dangerous investment philosophy

July 20, 2022

What is ‘Household Contents Cover’ and Why Do You Need It?

July 29, 2022Household Contents Cover and Building Insurance will indemnify you – What happens if your items are Underinsured?

When insuring our assets, we often give our insurers the values that we “assume” or “think” we could replace our items for; often underestimating what our items would cost to replace.

As we discussed in ‘Household Contents Cover Continued – How your Insurance is Calculated’ (read it here) and ‘We have Household Contents Covered, but what if you Own a Building and Do you Need to Cover it?’ (read it here), it is of utmost importance that our items are insured correctly and adequately to mitigate the chances of being underinsured in the event of a claim.

Underinsurance is when your assets are insured for LESS than what it would cost to replace or repair them.

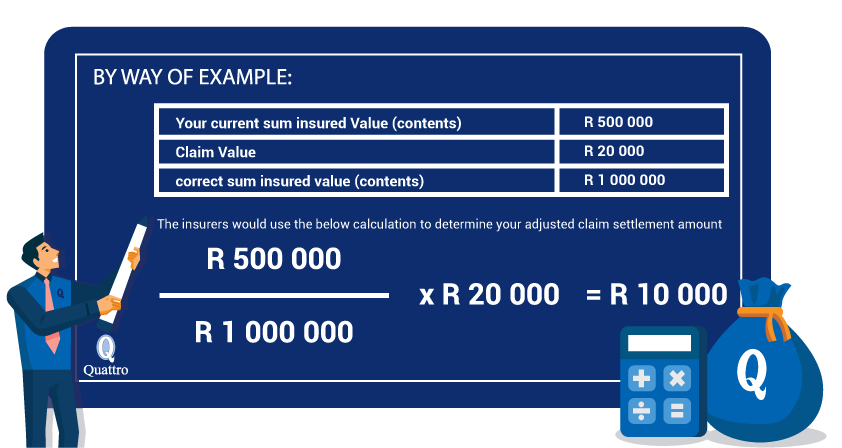

Whether incorrectly guessing the insured value, or purposefully reducing the insured value (to minimally save on premium), should you have a valid claim, you may be subject to the average clause.

What this means for you is that by underinsuring your assets, your claim settlement will be adjusted, and you will be indemnified less than what your assets are correctly valued at.

At Quattro Sure, we have a team of insurers that will provide you with a valuation/inventory service on your Building and Household Contents, to determine the accurate rebuilding/replacement costs of your assets; completely mitigating the chances of you being underinsured, should a valid claim occur. This fantastic service is included in your monthly premium.

To ensure your property is correctly insured and you are not paying for something you do not need, contact the contact Quattro Sure to get started on 031 242 5100 or use the form below.

If you missed these articles, click to read more

‘What is Household Contents Cover and Why Do You Need It?’ – read it here.

‘Household Contents Cover Continued – How is your Insurance Calculated’ – read it here.